Explain How Option Contracts Are Different From Futures Contracts

In finance a derivative is a contract that derives its value from the performance of an underlying entity. Derivatives can be used for a number of purposes including insuring against price movements increasing exposure to price movements for speculation or getting access to.

Futures Market Meaning Working Options Differences With Cash Market

Accounting for Derivative Instruments.

. We will be using this option on expiry day in case the cash balance and the intrinsic value of the option contract is less than twice the SPANExposure margin Exchange mandated required to take a position in the futures contract of the same stock for the current expiry. Both an option and a future allow an investor to buy an investment at a specific price by a specific date. Hedging in a way helps you to protect your trading positions from making a.

Precious metals such as gold and silver can be bought directly whereas goods like. This underlying entity can be an asset index or interest rate and is often simply called the underlying. Exchanges have provided an option to not exercise long CTM contracts.

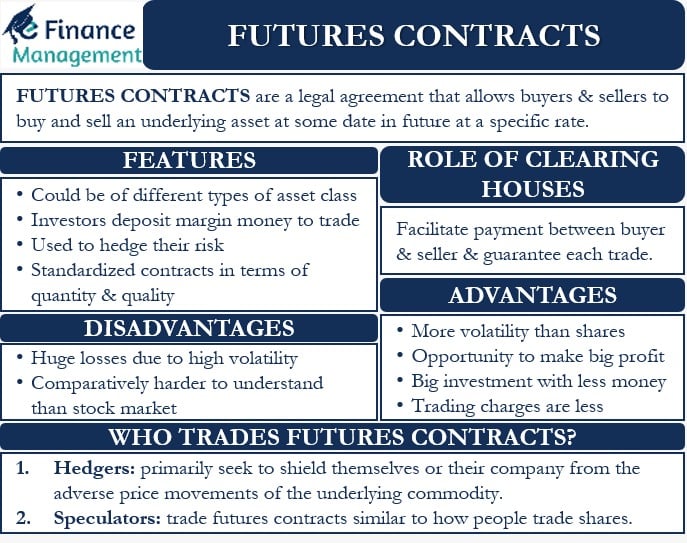

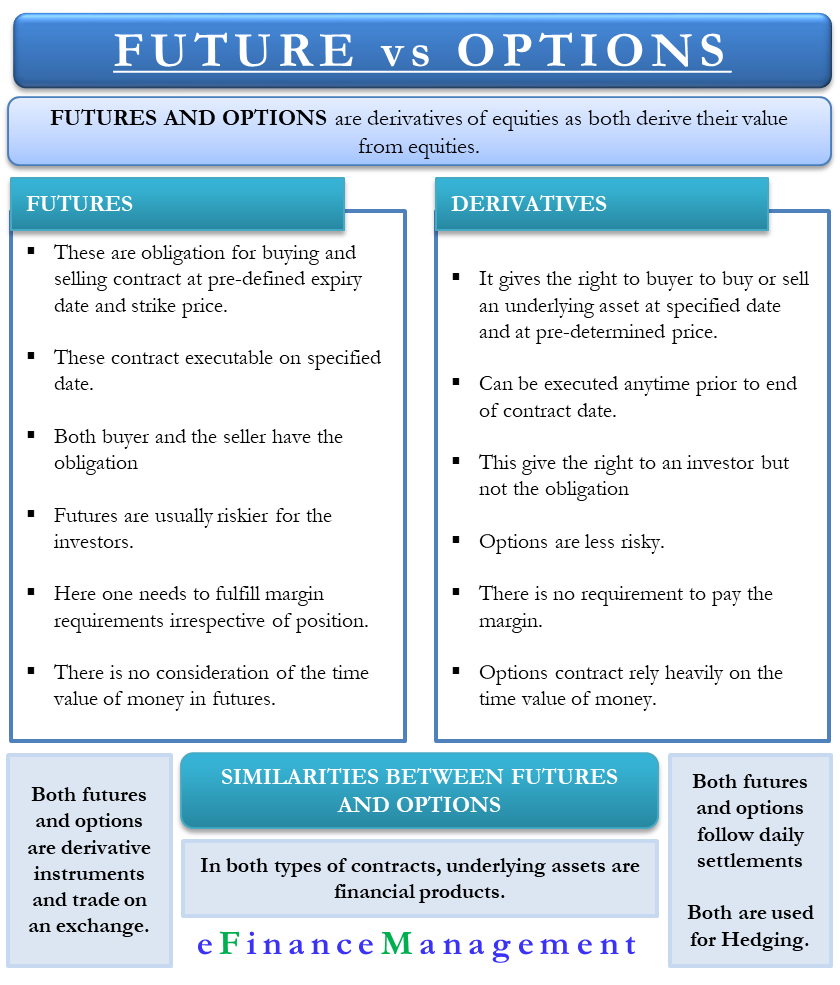

But the markets for these two products are very different in. Hedging helps to reduce the risk of adverse price fluctuations in an asset. Futures contracts are a.

Under current international accounting standards and Ind AS 109 an entity is required to measure derivative instruments at fair value or mark to. Accounting for derivatives is a balance sheet item in which the derivatives held by a company are shown in the financial statement in a method approved either by GAAP or IAAB or both. A hedge can be made from various financial instruments including stocks insurance forward contracts swaps options futures contracts.

There are a few ways to invest in commodities the most common is through futures contracts exchange-traded funds ETFs or direct purchases.

What Are The Main Differences Between Forward And Futures Contracts

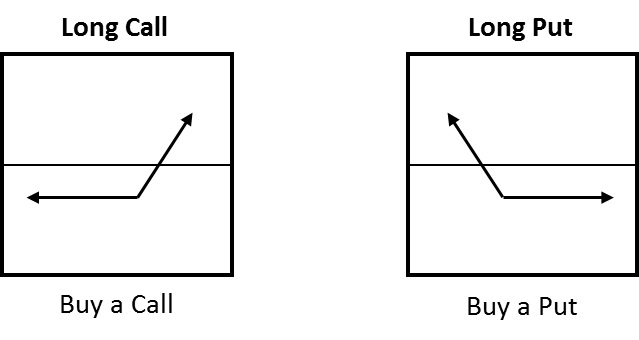

Options Vs Futures What S The Difference Warrior Trading

What Is A Futures Contract All You Need To Know Ig En

Futures Contracts Meaning Features Pros Cons And More

Futures Vs Options What S The Difference Ig En

Thinkorswim Options Trading Tutorial Youtube In 2022 Option Trading Options Trading Strategies Trading

What Is Futures And Options F O Trading A Beginners Guide

The Daily Definition Corner 1 The Act Of Securing Enough Controlling Interest Or Ownership Within A Sing Options Market Commodity Futures Futures Contract

Day Trading Day Trading Options For A Living Advanced Trading Strategies To Earn Income Online In Futures Cryptocurrency Stocks Forex Option Contracts In 2022 Option Trading Day Trading Stock Trading Strategies

Your Money Options Futures Know The Differences The Financial Express

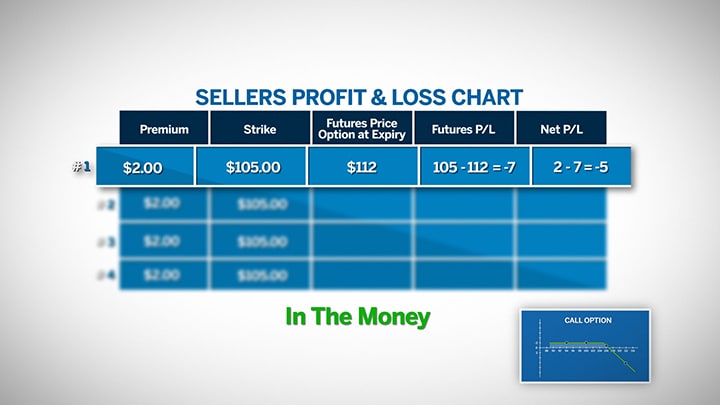

Understanding Options Expiration Profit And Loss Cme Group

Fundamentals Of Options On Futures Cme Group

Futures Vs Options All You Need To Know

What Is Expiration Date Expiry Cme Group

Futures Vs Options What S The Difference Ig En

What Is A Futures Contract All You Need To Know Ig En

What Is A Futures Contract All You Need To Know Ig En

What Models Are Most Often Used To Value Futures And Future Options What Is The Difference Homeworklib

/dotdash_final_An_Introduction_to_Options_on_SP_500_Futures_Jan_2021-01-28d0c2c4c569466384e3ae6123d56d27.jpg)

Comments

Post a Comment